Your client has saved 1860 for a down payment – As your client has saved $1860 for a down payment, this guide will provide a comprehensive overview of the significance of this milestone and the subsequent steps towards homeownership. This guide will delve into budgeting strategies, investment considerations, and homeownership preparation, empowering you with the knowledge and tools to navigate the path to homeownership.

Saving $1860 for a down payment is a significant accomplishment that brings you closer to the dream of homeownership. It demonstrates financial discipline and a commitment to responsible financial management. With a down payment in place, you gain a competitive edge in the housing market, qualify for more favorable mortgage terms, and reduce the overall cost of your home purchase.

Overview: Your Client Has Saved 1860 For A Down Payment

Saving $1860 for a down payment is a significant milestone in the homeownership journey. This amount can make a substantial impact on a potential home purchase, potentially lowering the mortgage amount and monthly payments.

For instance, a $1860 down payment on a $200,000 home would reduce the mortgage amount to $181,400, resulting in lower monthly payments and overall interest savings.

Benefits of Having a Down Payment Saved in Advance

- Lower mortgage amount and monthly payments

- Reduced interest charges over the life of the loan

- Improved chances of loan approval

- Demonstrates financial responsibility and stability

Budgeting and Planning

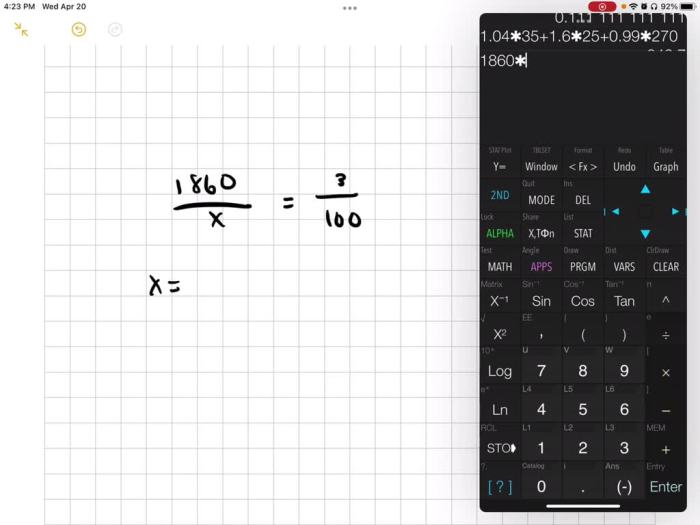

Budgeting Strategies to Achieve the $1860 Savings Goal

To save $1860, it is essential to create a realistic budget that prioritizes saving.

| Category | Suggested Amount |

|---|---|

| Housing | $400 |

| Transportation | $200 |

| Food | $300 |

| Utilities | $150 |

| Entertainment | $100 |

| Savings | $210 |

By following a budget and reducing unnecessary expenses, it is possible to allocate more funds towards saving.

Investment Considerations

Investment Options for Growing the $1860 Down Payment

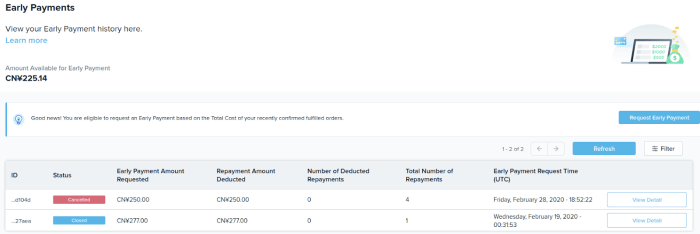

Once a budget is in place, consider investment options to grow the $1860 down payment.

Compound interestis a powerful concept that can significantly increase savings over time. By reinvesting interest earned, the savings grow exponentially.

Comparison of Investment Vehicles, Your client has saved 1860 for a down payment

- High-yield savings accounts:Offer higher interest rates than traditional savings accounts but may have limitations on withdrawals.

- Certificates of deposit (CDs):Offer fixed interest rates for a specified term, providing a guaranteed return but restricting access to funds.

- Mutual funds:Diversify investments across a range of assets, offering the potential for higher returns but also carrying more risk.

Homeownership Preparation

Next Steps After Saving the $1860 Down Payment

Once the $1860 down payment is saved, the next steps involve preparing for homeownership.

Getting Pre-Approved for a Mortgage

Pre-approval for a mortgage provides a clear understanding of the loan amount and interest rate you qualify for, making the home search process more efficient.

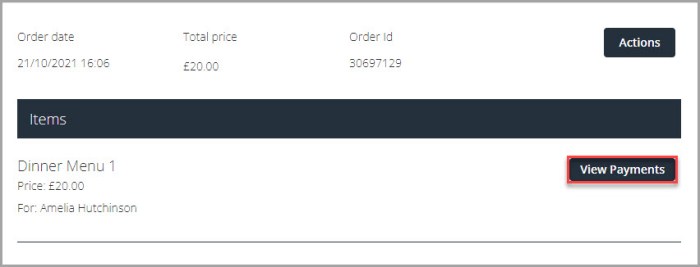

House Hunting and Making an Offer

With a pre-approval in hand, the house hunting process can begin. Once a suitable home is identified, it is time to make an offer, which should include the down payment amount.

FAQ Section

What are the benefits of saving a down payment in advance?

Saving a down payment in advance provides several benefits, including a lower monthly mortgage payment, reduced interest paid over the life of the loan, and increased equity in your home from the start.

How can I create a budget to achieve my down payment goal?

To create a budget, track your income and expenses to identify areas where you can reduce spending. Allocate a specific amount towards your down payment savings each month and explore additional income streams to supplement your savings.

What investment options should I consider for my down payment savings?

Consider high-yield savings accounts, certificates of deposit (CDs), and mutual funds for your down payment savings. These options offer varying levels of risk and return, so choose the one that aligns with your financial goals and risk tolerance.