In the realm of financial calculations, understanding the periodic interest rate is paramount. Calculate the periodic interest rate in cell E3 provides a comprehensive exploration of this concept, delving into its formula, factors, methods, and significance. Embark on this journey to unravel the intricacies of periodic interest rates and their crucial role in financial decision-making.

This guide will provide a detailed explanation of the periodic interest rate, its calculation methods, and its impact on financial calculations. We will also discuss the advantages and disadvantages of different calculation methods and provide a step-by-step procedure for calculating the periodic interest rate.

Additionally, we will explore real-world examples to illustrate the practical applications of this concept.

Periodic Interest Rate: Calculate The Periodic Interest Rate In Cell E3

The periodic interest rate, often referred to as the nominal interest rate, represents the percentage of interest charged or earned on a loan or investment over a specific period of time, typically a year.

Formula for Calculating Periodic Interest Rate, Calculate the periodic interest rate in cell e3

The periodic interest rate (r) can be calculated using the following formula:

r = (Interest Payment / Principal) x (Number of Periods / Year)

Where:

- Interest Payment: The amount of interest paid or earned during the period.

- Principal: The initial amount borrowed or invested.

- Number of Periods: The number of periods (e.g., months, quarters) within the year.

- Year: The duration of the period over which the interest rate is calculated, typically a year.

Factors Affecting Periodic Interest Rate

Several factors influence the periodic interest rate, including:

- Risk:Lenders charge higher interest rates to borrowers perceived as riskier.

- Inflation:Interest rates tend to rise during inflationary periods to compensate for the decline in the purchasing power of money.

- Economic Conditions:Interest rates are often influenced by macroeconomic factors such as economic growth, unemployment, and government policies.

- Market Demand:The supply and demand for funds in the financial market also affect interest rates.

FAQ Corner

What is the periodic interest rate?

The periodic interest rate is the interest rate applied to a loan or investment over a specific period, typically a month or a year.

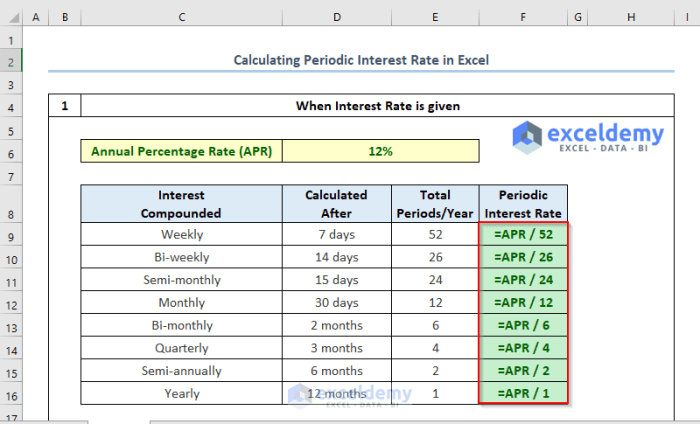

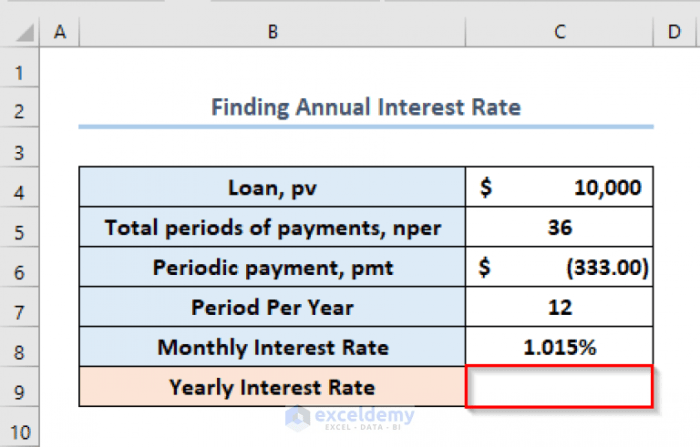

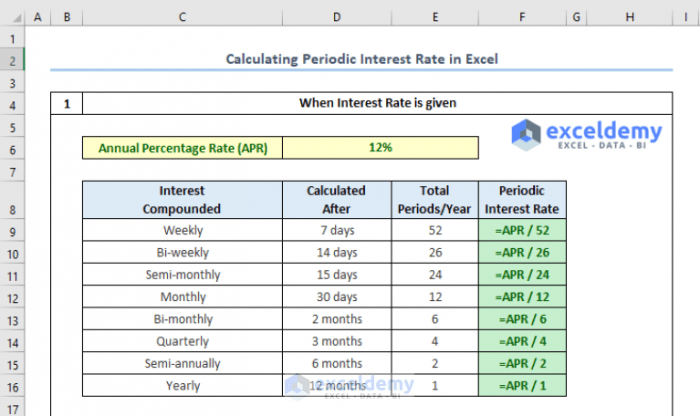

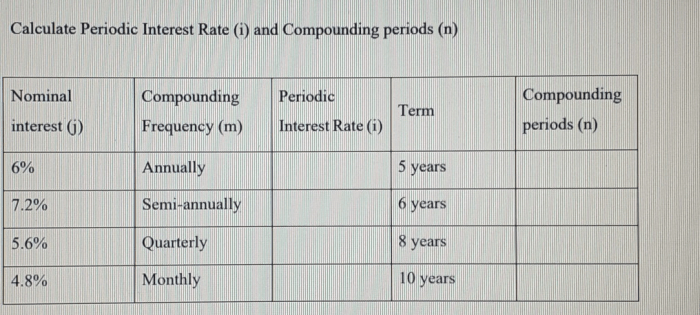

How do I calculate the periodic interest rate?

The periodic interest rate can be calculated using the formula: Periodic Interest Rate = Annual Interest Rate / Number of Periods per Year

What are the factors that affect the periodic interest rate?

The periodic interest rate is influenced by several factors, including the annual interest rate, the number of periods per year, and the type of loan or investment.