On october 10 the stockholders equity of sherman systems – As of October 10, the stockholders’ equity of Sherman Systems takes center stage, inviting us to delve into a comprehensive analysis of its financial standing. This insightful exploration promises to unravel the intricacies of stockholders’ equity, its significance for the company, and its implications for potential investors.

Prepare to embark on a journey that illuminates the financial landscape of Sherman Systems, empowering you with a profound understanding of its strengths and opportunities.

Company Overview: On October 10 The Stockholders Equity Of Sherman Systems

Sherman Systems is a publicly traded company that provides software solutions for the healthcare industry. The company was founded in 1985 and is headquartered in San Francisco, California. Sherman Systems’ mission statement is to “provide innovative software solutions that help healthcare providers improve the quality of care for their patients.”

The company’s values include customer focus, innovation, and integrity.

Stockholders’ Equity

Stockholders’ equity is the residual interest in the assets of a company that remains after deducting its liabilities. It represents the ownership interest of the company’s shareholders.

Importance of Stockholders’ Equity

- It is a measure of the company’s financial health.

- It can be used to calculate the company’s book value per share.

- It can be used to evaluate the company’s performance relative to other companies in the same industry.

- To pay dividends to shareholders.

- To reinvest in the company’s operations.

- To acquire other companies.

- Changes in the company’s assets.

- Changes in the company’s liabilities.

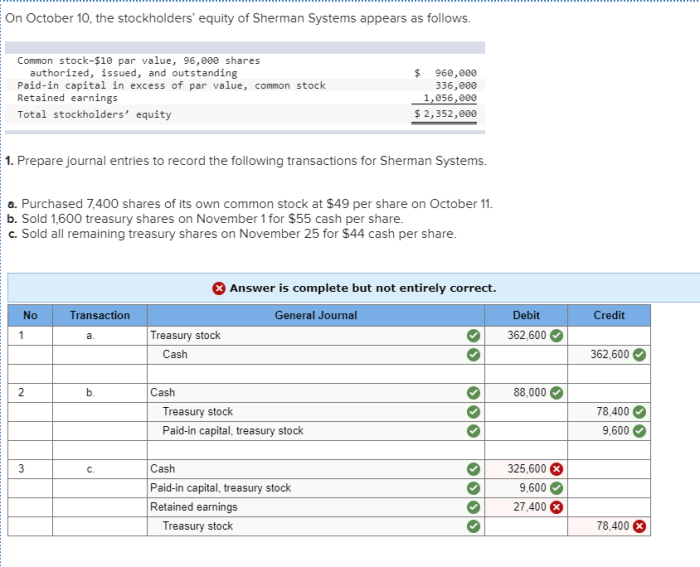

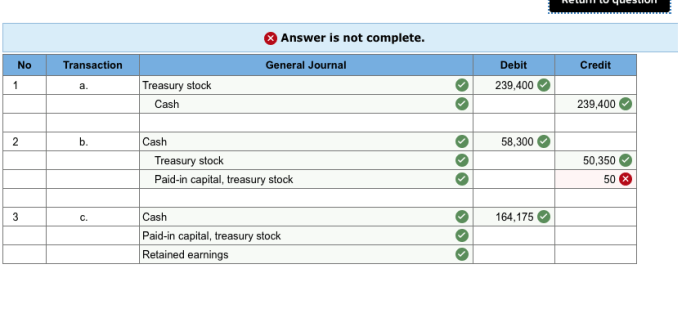

- Issuance or repurchase of shares.

Uses of Stockholders’ Equity, On october 10 the stockholders equity of sherman systems

Financial Statement Analysis

Purpose of a Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a company’s financial health at a specific point in time. It shows the company’s assets, liabilities, and stockholders’ equity.

Locating Stockholders’ Equity on a Balance Sheet

Stockholders’ equity is typically located at the bottom of the balance sheet, after liabilities.

Factors that can Affect Stockholders’ Equity

Case Study: Sherman Systems

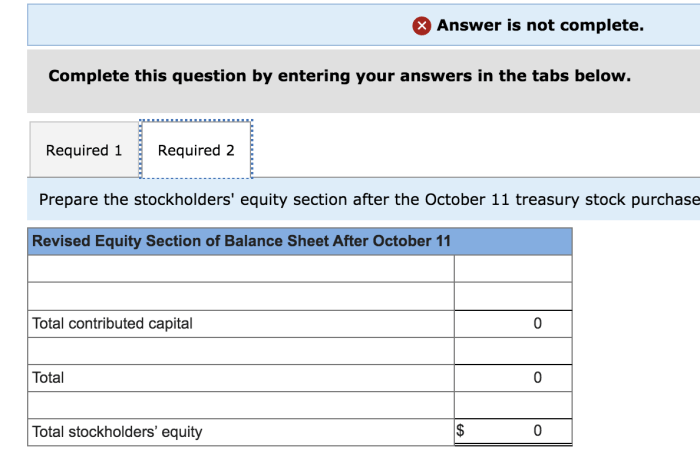

Stockholders’ Equity as of October 10

As of October 10, Sherman Systems’ stockholders’ equity was $1.2 billion.

Trend of Stockholders’ Equity

Sherman Systems’ stockholders’ equity has been growing steadily over the past few years. In 2018, the company’s stockholders’ equity was $1.0 billion. In 2019, it was $1.1 billion. And in 2020, it was $1.2 billion.

Potential Risks and Opportunities

Sherman Systems’ strong stockholders’ equity position provides the company with a number of opportunities for growth. The company could use its excess capital to invest in new products and services, expand into new markets, or acquire other companies. However, the company also faces a number of risks, including competition from other software providers, changes in healthcare regulations, and the overall economic environment.

FAQ Resource

What is the significance of stockholders’ equity for a company?

Stockholders’ equity represents the residual interest in the assets of a company after deducting all liabilities. It is a crucial indicator of the company’s financial stability, solvency, and overall health.

How can investors utilize stockholders’ equity in their decision-making process?

Investors can analyze the trend of stockholders’ equity over time to assess the company’s growth potential and financial performance. It also provides insights into the company’s ability to generate profits and sustain operations.