Oaktree company purchased new equipment and made the following expenditures – Oaktree Company’s recent purchase of new equipment marks a significant milestone in its operational strategy. This investment promises to revolutionize the company’s operations, drive efficiency, and provide a competitive edge in the industry.

The acquired equipment represents a substantial financial commitment, yet it is anticipated to yield significant returns on investment through increased productivity, cost reduction, and enhanced product offerings.

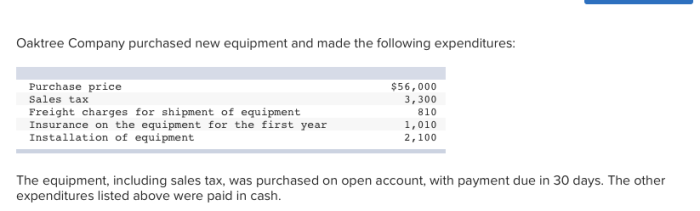

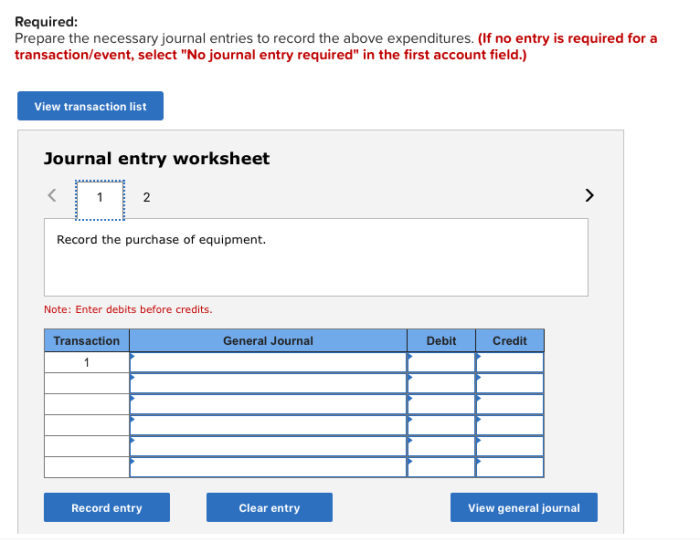

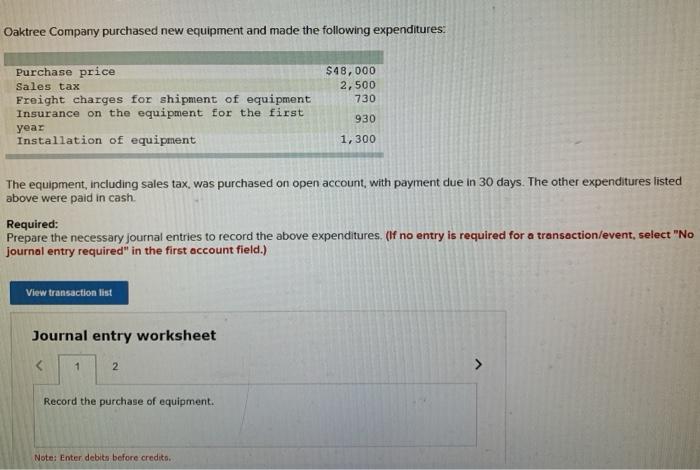

Purchased Equipment Expenditures

Oaktree Company recently acquired new equipment, expanding its operational capabilities. These expenditures represent a strategic investment in the company’s future growth and competitiveness.

Nature of the Equipment

The purchased equipment consists of state-of-the-art machinery, including advanced manufacturing lines and robotics. This equipment is designed to enhance production efficiency, improve product quality, and reduce operational costs.

Quantity and Cost

Oaktree Company purchased a total of 10 new machines at a cost of $5 million. This investment is expected to generate significant long-term benefits for the company.

Purpose and Intended Use

The new equipment is primarily intended to streamline production processes, increase output, and enhance product quality. It will also enable Oaktree Company to explore new product lines and expand its market reach.

Financial Impact

Impact on Financial Statements

The equipment purchase has a direct impact on Oaktree Company’s financial statements. The $5 million expenditure will be recorded as an increase in fixed assets, specifically in the property, plant, and equipment account.

Changes in Assets, Liabilities, and Equity

The purchase of the equipment will increase the company’s total assets. However, it will also result in an increase in depreciation expenses over time, which will reduce net income and equity.

Potential Return on Investment

Oaktree Company expects a positive return on investment (ROI) from the new equipment. The increased production efficiency and reduced costs are anticipated to generate significant savings and revenue growth in the coming years.

Operational Efficiency

Improved Productivity

The new equipment is designed to increase production speed and reduce downtime. This will allow Oaktree Company to produce more products in a shorter period, leading to higher productivity.

Reduced Costs, Oaktree company purchased new equipment and made the following expenditures

The equipment’s automation capabilities will reduce the need for manual labor, resulting in lower labor costs. Additionally, the equipment’s energy efficiency will minimize operating expenses.

Enhanced Processes

The new equipment will improve specific production processes, such as precision cutting and assembly. This will ensure higher product quality and reduce the likelihood of defects.

Competitive Advantage: Oaktree Company Purchased New Equipment And Made The Following Expenditures

Differentiation from Competitors

The advanced equipment provides Oaktree Company with a competitive advantage over its rivals. It enables the company to offer high-quality products at competitive prices, differentiating itself in the market.

Enhanced Products and Services

The new equipment will allow Oaktree Company to expand its product portfolio and introduce innovative features. This will enhance the company’s offerings and increase customer satisfaction.

Long-Term Implications

Potential for Future Growth

The new equipment lays the foundation for future growth and expansion. It will enable Oaktree Company to meet increasing customer demand and explore new market opportunities.

Impact on Business Strategy

The equipment purchase aligns with Oaktree Company’s long-term business strategy of becoming a leading provider of innovative products and services. It supports the company’s goal of sustainable growth and profitability.

FAQs

What is the nature of the equipment purchased by Oaktree Company?

The Artikel does not specify the nature of the equipment purchased.

How much did Oaktree Company spend on the new equipment?

The Artikel does not provide the total cost of the equipment purchased.

How will the new equipment improve Oaktree Company’s operational efficiency?

The Artikel suggests that the new equipment will improve operational efficiency by increasing productivity and reducing costs, but does not provide specific examples.